We all know that the occasional 'great kahuna' trade is all we need to make

things better again after a losing streak. But how about not falling into the temptation

of taking silly trades before the high probability, high reward set-up

manifests itself in the first place?

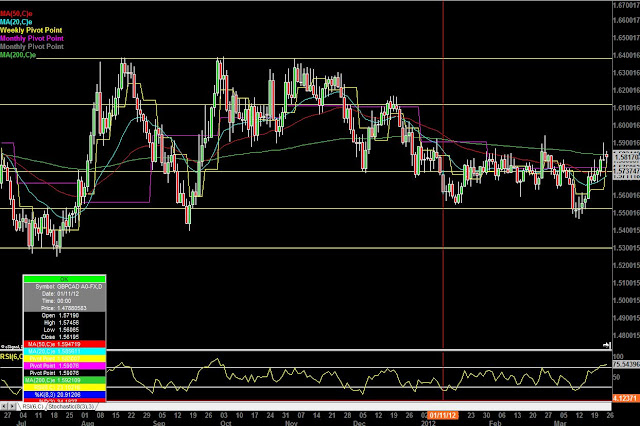

If you had traded GBPCAD and its low test bar off a very strong level of

support on 20th July 2011 (confirmed with inverse head and shoulders on the

lower timeframe) to the conservative target of: 16087, you would have made

about 15% (risking 1%). Had you traded it short once it got to the top of its

range in August and taken it to target three quarters of the way down to the

bottom (50 pip stop), you will have made an additional 17%. Had you done the

same again in September, you would have most likely have broken even if you're

unlucky but those who held their nerve in November who did the same YET AGAIN

would have been rewarded by another 17% by simply selling the top of the range

and taking profit three quarters of the way down for a higher probability/lower

reward outcome.

That's 49% made in 4 trades....in under 1 year! Trading a strategy which is

as old as the hills.

Did you spot any of those set ups?

Do not worry if you did not, because the great news is...the range is STILL

IN PLAY. The levels of support and resistance remain unbroken and this has been

the case for the past 2 years. So all we need to do is lie in wait for price

action to get up to the level of resistance in order to sell, or down to the

level of support for us to buy.

The patience is the hard part. Even if this kind of trade is the only thing

you do all year, you are head and shoulders above many traders out there who

will challenge you for not trading as frequently as them.

You see, while they may smugly think you are a 'part-timer', not

serious and potentially not as good as them lower frequency traders should

remember those people have an ego while we do it for the money (or rather,

capital growth)...and while intra-day traders demonstrate their ability to have

a high level of interactivity with the market on a daily basis, we, in turn

demonstrate our discipline in staying out the market until our chosen set up is

ready...even if we have to wait 3 months for it!! Each side of the coin have

their unique skill sets.

This is just an extreme example - I am not that low frequency...but I can

happily live live being so.

Can I use your stratergy on lower horz levels so a to have a bit of a higher frequency of trades as I have only been trading 6 mnths and need more screen time, but cannot get caught up in intraday due other business commitments

ReplyDelete